Understanding Gift Aid: How It Works and Its Tax Benefits

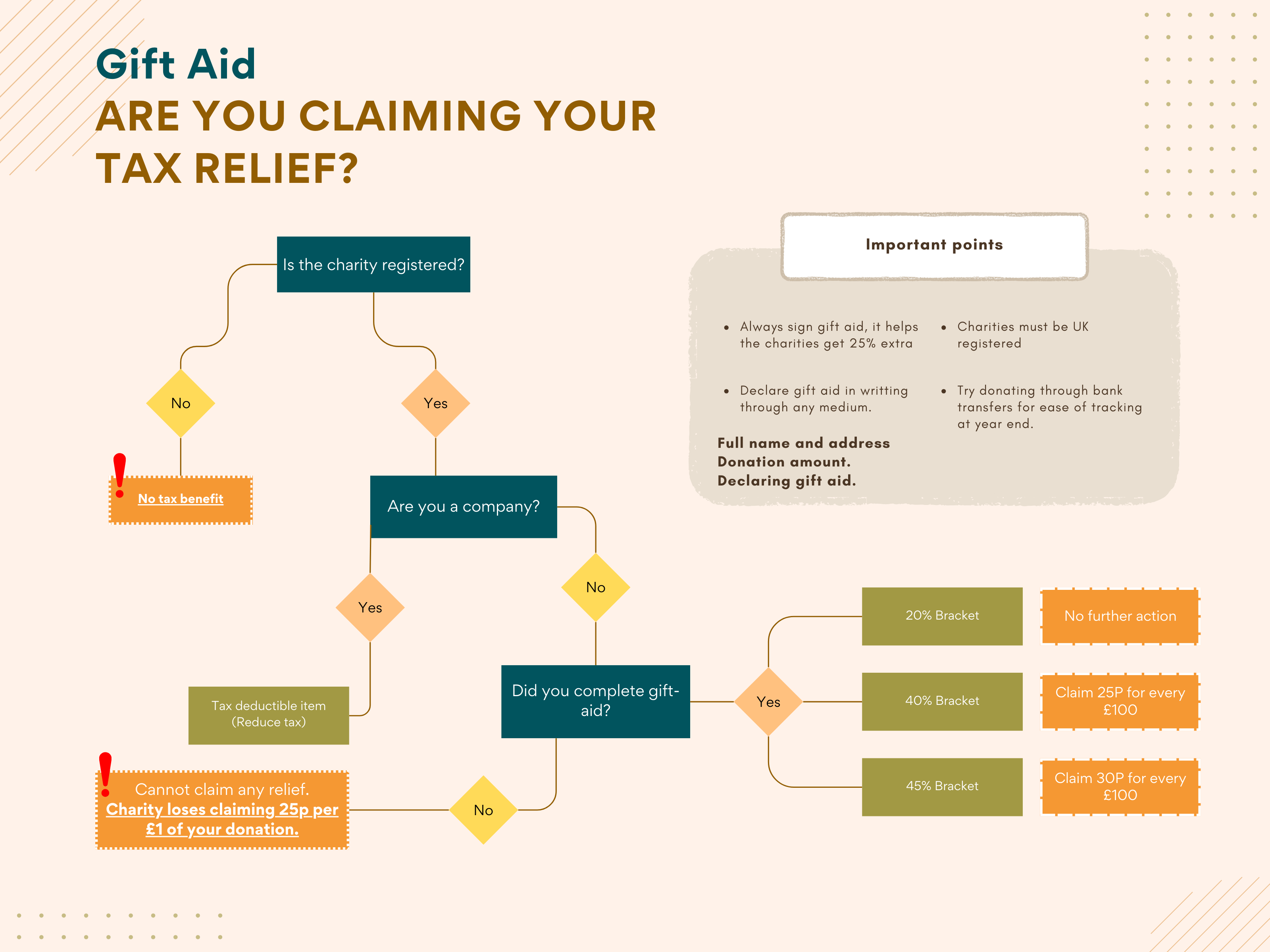

Gift Aid is a UK government scheme designed to encourage charitable donations by allowing charities to reclaim the basic rate of tax on donations made by UK taxpayers. This means that for every £1 donated, charities can claim an additional 25p from HM Revenue & Customs (HMRC), boosting the value of donations at no extra cost to the donor.

How Gift Aid Works

To participate in Gift Aid, donors must:

- Make a Gift Aid declaration: This involves providing the charity with your name, address, and confirmation that you pay UK tax.

- Ensure sufficient tax payment: You must have paid enough tax to cover the amount the charity will reclaim. If not, HMRC may ask you to pay the difference.

Tax Benefits for Different Tax Brackets

20% Tax Bracket (Basic Rate Taxpayers)

For basic rate taxpayers, the primary benefit of Gift Aid is the increased value of their donation to the charity. While there is no additional personal tax relief for basic rate taxpayers, their donations are worth 25% more to the charity. For example, a £100 donation becomes £125 for the charity.

40% and 45% Tax Brackets (Higher and Additional Rate Taxpayers)

Higher rate (40%) and additional rate (45%) taxpayers can claim back the difference between the basic rate and their personal tax rate on the gross donation amount. Here’s how it works:

- Higher Rate Taxpayers (40%): If you donate £100, the charity claims £25, making the total donation £125. You can claim back 20% of the gross donation (£125 x 20% = £25), reducing your tax bill.

- Additional Rate Taxpayers (45%): Similarly, if you donate £100, the charity claims £25, making the total donation £125. You can claim back 25% of the gross donation (£125 x 25% = £31.25), reducing your tax bill.

To claim this relief, higher and additional rate taxpayers must include their Gift Aid donations on their Self Assessment tax return.

Corporate Bodies

Corporate Gift Aid works differently from individual Gift Aid. When companies donate to charity, they can deduct the donation amount from their profits before calculating their corporation tax. This reduces their taxable profits and consequently their corporation tax liability.

For example, if a company donates £1,000 to a charity, it can deduct this amount from its profits, lowering its corporation tax bill. This system encourages corporate charitable giving by providing a financial incentive.

Maximizing Gift Aid Benefits

To make the most of Gift Aid:

- Complete a Gift Aid declaration for each charity you donate to.

- Keep records of all donations made throughout the tax year.

- Include donations on your Self Assessment tax return if you are a higher or additional rate taxpayer.