Introduction

Making Tax Digital (MTD) is a significant initiative by the UK government aimed at modernizing the tax system. It requires businesses and individuals to maintain digital records and submit tax information digitally, enhancing accuracy and efficiency in tax reporting. This article explores the key deadlines and implications of MTD for self-employed individuals and small to medium-sized enterprises (SMEs).

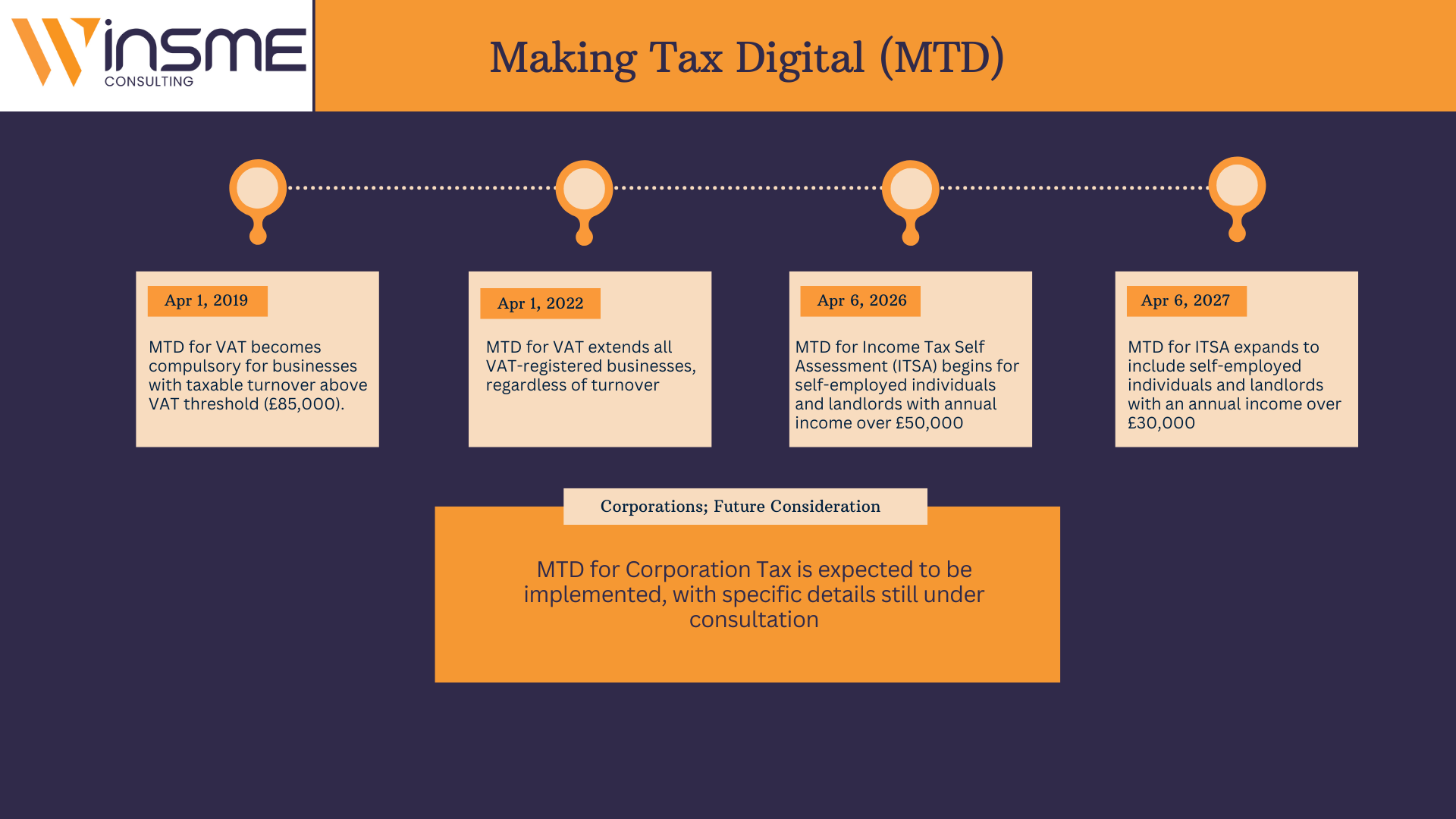

Key Deadlines

- For VAT-Registered Businesses:

- MTD for VAT has been in effect since April 2019 for businesses with a taxable turnover above the VAT threshold. As of April 2022, this requirement extends to all VAT-registered businesses, regardless of turnover

- For Income Tax:

- April 6, 2026: Self-employed individuals and landlords with an annual income exceeding £50,000 must comply with MTD requirements.

- April 6, 2027: Those with an annual income over £30,000 will be required to follow MTD guidelines

These phased deadlines allow businesses to prepare for the transition to a fully digital tax system.

Implications for Self-Employed Individuals

- Digital Record Keeping

Self-employed individuals will need to maintain digital records of their income and expenses. This shift aims to reduce errors and streamline the tax filing process. Using compatible software will be essential for submitting quarterly updates to HMRC.

- Quarterly Updates

Instead of the traditional annual tax return, self-employed individuals will submit updates every quarter. This change encourages more regular monitoring of financial performance and tax obligations, potentially leading to better financial management.

- Reduced Tax Gap

By digitizing tax records, the government aims to minimize the tax gap—estimated at around £5 billion for self-assessment businesses—by reducing errors and improving compliance.

Implications for SMEs

- Increased Compliance Costs

While MTD aims to simplify tax processes, SMEs may face initial costs associated with transitioning to digital systems. HMRC estimates a transitional cost of approximately £561 million for businesses adapting to MTD.

- Enhanced Efficiency

Once familiar with the new system, SMEs may find that MTD simplifies their tax management. Digital tools can integrate tax processes with other business operations, potentially increasing overall productivity.

- Support and Resources

HMRC is committed to providing support through webinars, guidance videos, and dedicated customer service to help businesses navigate the transition. This support is crucial for SMEs that may lack the resources to adapt quickly.

Conclusion

Making Tax Digital represents a transformative shift in how self-employed individuals and SMEs manage their tax affairs. While the transition may pose challenges, the long-term benefits of improved accuracy, efficiency, and reduced tax gaps are significant. As the deadlines approach, businesses should begin preparing for these changes to ensure compliance and leverage the advantages of a digital tax system.

All of our services are fully MTD compliant. Talk to us today!