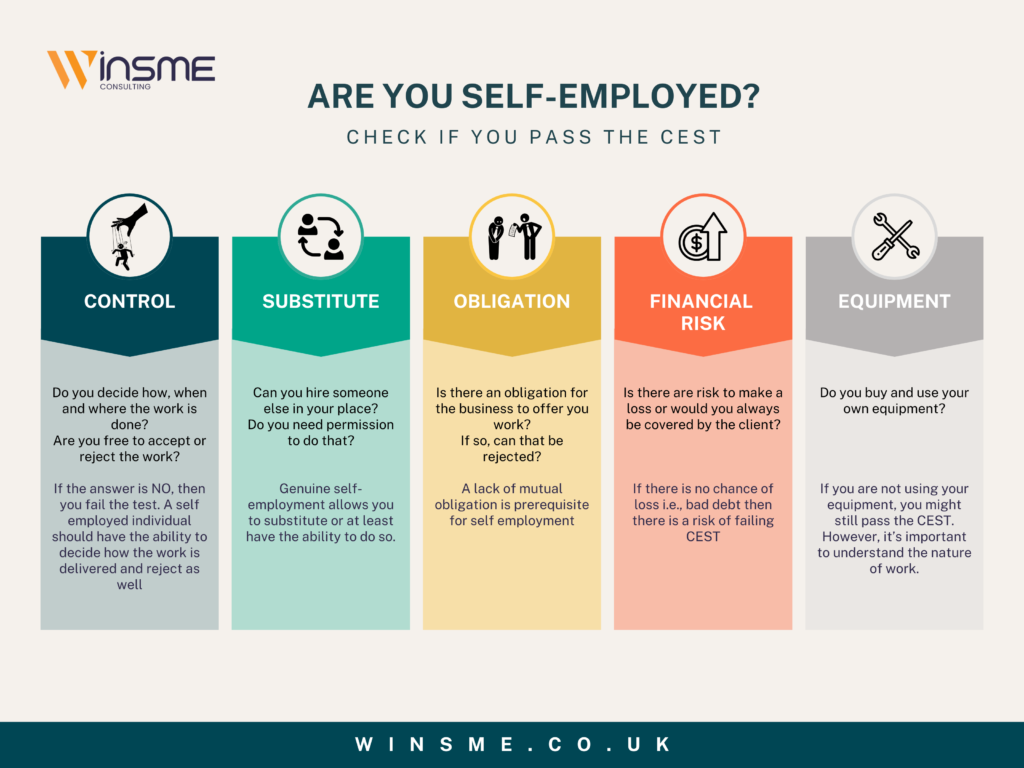

Self-Employed? Do you pass CEST?

HMRC uses a set of criteria to determine whether an individual is genuinely self-employed. These include: Control: Do you decide how, when, and where you work? Substitution: Can you send someone else to do the work? Financial Risk: Do you bear the risk of making a loss? Provision of Equipment: Do you supply your own tools or materials? Opportunity for Profit: Can you increase your earnings through efficiency or business decisions? Mutuality of Obligation: Is there an expectation that work will be offered and accepted on a continuous basis?# Risk as an employee If you fail the test. There will be significant fines for the unpaid income tax and NICs. This can be backdated up to 6 years. Interest on unpaid tax and NICs If deliberate or negligent, then there could be fines of up to 100% of the unpaid tax. Unable to claim any business expenses. All of those will be added back as income and taxes at either 20%,40% or 45% plus NI. Risk as an employer Failing the test is equally problematic for the employer. Fines for underpaying the employer’s NIC. 15% from April 2025. Fine for underpaying the employer pension contribution. Interest and fine for negligence. Both the employer and the self-employed individual need to assess their situation. If in doubt, speak to your accountant.